Life Insurance Quote for Someone with COPD

How to Get Life Insurance with COPD

Do You Have COPD and Need Life Insurance Coverage?

|

Trying to find a life insurance policy may be difficult if you have COPD. However, there are burial expense insurance policies available that offer you a quicker and easier way to get the life insurance you need without the delays and hassles of a traditional life insurance policy. People with COPD or other serious health issues can purchase life insurance policies with guaranteed acceptance. |

|

Some life insurance plans offer guaranteed approval for people meeting the age requirements.

That means, you cannot be turned down for

any reason, including health issues.

Guaranteed Issue life insurance policies may offer you the choice of coverage from $2,000 up to $25,000 depending on your age. And, with guaranteed approval policies you will not have to take any physical examination or answer any questions about your health history.

Top Pick – Mutual of Omaha

Mutual of Omaha offers guaranteed acceptance whole life insurance for people age 45 to 85. Choose $2,000 up to $25,000 of coverage. Rates start as low as $8.84 per month. There’s no medical exam and no health questions. You cannot be turned down. You can get a quote and apply online now. START HERE to get a FREE Quote.

- Your life insurance policy comes with a 30 day Risk-Free, Money-Back Guarantee

Highly Recommended – Allstate Benefits Insurance Company

Allstate Benefit's Guaranteed Acceptance policy offers $10,000 to $75,000 of coverage to working applicants between the ages of 18 and 70. Rates start as low as $9.65 per month. There’s no medical exam and no health questions. You cannot be turned down. You can get a quote and apply today. No waiting period. Start Here to get a FREE Quote.

NOTE: To qualify, applicants must be working at least 20 hours per week, and not collecting any form of disability income or SSDI.

Guaranteed Acceptance Life Insurance Explained

What is Guaranteed Acceptance Life Insurance?

Guaranteed life insurance is a type of permanent life insurance plan that provides lifetime protection and guarantees your approval for coverage if you meet the age requirement.

Guaranteed policies may offer up to $25,000 of life insurance coverage. But you may be able to choose from $3,000 up to $25,000 of coverage.

The proceeds from your guaranteed issue life insurance policy will go direct to the beneficiary of your choosing.

The benefits are paid out free from federal income tax. Your beneficiary can use the money to pay for the costs related to your burial and funeral, or for any purpose they see fit.

According to a study by the National Funeral Directors Association the average cost of a funeral and related burial and final expenses is $8,750 (2021).

Source: National Funeral Directors Association

COPD Explained

What is COPD?

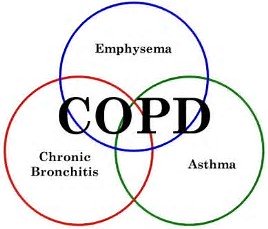

COPD is Congestive Obstructive Pulmonary Disease which may include several different respiratory disorders; such as, chronic bronchitis and emphysema. It is a progressive disease that makes it difficult to breathe. Its gets worse over time.

COPD is a chronic inflammatory lung disease that causes obstructed airflow from the lungs.

Symptoms of COPD include coughing, wheezing, shortness of breath, and tightness in the chest. The leading cause of COPD is smoking. Quitting smoking may improve your chances of not developing this disease.

It’s caused by long-term exposure to irritating gases or particulate matter, most often from smoking cigarettes. People with COPD are at increased risk of developing heart disease, lung cancer and other health conditions.

COPD is the third leading cause of death in America and a major cause of disability.

Common Causes of COPD include:

- Smoking

- Air Pollution

- Dust

- Chemical Fumes

Source: Mayo Clinic

Fully Underwritten Life Insurance for People with COPD

Life insurance for someone with COPD (Chronic Obstructive Pulmonary Disease) can be more expensive and difficult to obtain than for someone without the condition. However, it is still possible for individuals with COPD to get life insurance.

Insurance companies will typically consider factors such as the severity of the COPD, the individual's age, and overall health when determining the cost and availability of coverage.

Some insurance companies may require a medical examination before issuing a policy and may also ask for additional information such as medical records.

It may be helpful to work with a broker or independent agent who specializes in life insurance for individuals with pre-existing conditions. These professionals can help you compare policies and find coverage that fits your needs and budget.

Additionally, consider taking out a term life insurance policy as opposed to a whole life policy can also help lower the cost of coverage and make it more affordable for someone with COPD.

Stages of COPD

When applying for life insurance with COPD, insurance companies will typically consider the severity of the condition, which is usually categorized into four stages: mild, moderate, severe, and very severe.

Individuals with mild COPD will typically have an easier time obtaining coverage and at a lower cost than those with more severe stages.

The insurance company will also consider the individual's age and overall health when determining the cost and availability of coverage. Generally, the younger and healthier the individual, the more affordable the coverage will be.

Medical Examination for Coverage

A medical examination will also be required by most insurance companies before issuing a policy.

The examination will typically include a spirometry test, which measures lung function, as well as a complete medical history and physical examination.

The insurance company may also ask for additional information such as medical records and may require a statement from the individual's healthcare provider.

It's important to note that some insurance companies may decline coverage for individuals with COPD, while others may charge higher premiums or impose exclusions or restrictions on coverage. It may be helpful to work with a broker or independent agent who specializes in life insurance for individuals with pre-existing conditions. These professionals can help you compare policies and find coverage that fits your needs and budget.

Term Life Insurance

Additionally, considering to take out a term life insurance policy as opposed to a whole life policy can also help lower the cost of coverage and make it more affordable for someone with COPD.

A term life insurance policy provides coverage for a specific period of time, usually 10, 20 or 30 years, and is generally less expensive than a whole life policy, which provides coverage for the entire lifetime of the individual.

Whole life insurance can cost up to 5-10 times more than term life insurance.

Shop and Compare Life Insurance Policies

If you have COPD and are looking for life insurance, it's important to shop around and compare policies from different insurance companies.

Be prepared to provide detailed information about your condition and overall health, and be upfront about any other pre-existing conditions you may have. With the right coverage and the right insurance company, you can ensure that your loved ones will be financially protected in the event of your death.

NOTE: It's also important to keep in mind that if you're diagnosed with COPD after you've purchased life insurance, you may be able to convert your term life insurance policy to a permanent policy, such as whole life, without having to go through underwriting again.

Summary

Buying life insurance with COPD can be more expensive and difficult than for those without the condition; however, it is still possible.

Various factors such as the severity of COPD, age, overall health, and the type of policy will be considered by the insurance company when determining the cost and availability of coverage.

It is advisable to work with a broker or independent agent who specializes in life insurance for individuals with pre-existing conditions, compare policies and take out a term life insurance policy to make coverage more affordable.

Best Life Insurance Company for COPD

It can be difficult to determine the "best" life insurance company for individuals with COPD, as each company has its own underwriting guidelines and policies for individuals with pre-existing conditions.

However, some insurance companies are known for being more lenient and accommodating in terms of acceptance and pricing for people with chronic illnesses such as COPD.

Here are a few life insurance companies that you may consider when searching for life insurance with COPD:

- Mutual of Omaha: This company is known for being one of the most lenient when it comes to accepting applicants with COPD. They may offer coverage to individuals with mild to moderate stages of the condition, and may also offer lower rates than some other insurance companies.

- Prudential: Prudential may also be a good option for those with COPD. They are flexible with their underwriting guidelines and may offer coverage to individuals with moderate to severe stages of the condition.

- AIG: AIG may also offer coverage to individuals with COPD, depending on the severity of the condition. They have a variety of options for coverage and may also offer lower rates than some other insurance companies.

- Transamerica: This company may also be a good option for individuals with COPD. They may offer coverage to individuals with mild to moderate stages of the condition, and may also offer lower rates than some other insurance companies.

- John Hancock: John Hancock may also be a good option for those with COPD, they may offer coverage to individuals with moderate to severe stages of the condition.

It's important to keep in mind that each insurance company has its own underwriting guidelines and policies, so it's best to work with a broker or independent agent who specializes in life insurance for individuals with pre-existing conditions, to help you compare policies and find coverage that fits your needs and budget.

It's also important to keep in mind that the best life insurance company for a person with COPD will vary based on their specific needs and situation. It's important to shop around and compare policies from different insurance companies, and be upfront about your condition and overall health to get the best deal.

Life Insurance Quotes

Top Pick – JRC Insurance Group

JRC Insurance Group helps you shop, compare and save on life insurance. Regardless of your age or health background, we'll shop our 50+ life insurance companies and find you affordable life insurance you need to protect your family and fit your budget. Compare the best life insurance rates for savings up to 73%. Get Your FREE Quote.

Life Insurance Quote for Someone with COPD

Life Insurance for Uninsurable People

Life Insurance for COPD Sufferers

Disclosure: Compensated Affiliate