Life Insurance for Diabetes

How to Secure Coverage and Protect Your Loved Ones

When you’re diagnosed with diabetes, life insurance might seem like a daunting prospect.

You may wonder how this chronic condition affects your eligibility, premiums, and overall coverage options.

Rest assured, while diabetes does impact life insurance, it doesn’t close the door to securing a good policy.

Guide to Understanding Diabetic Life Insurance

Quick Review

Life insurance for individuals with diabetes is designed to provide financial protection while considering the unique health challenges associated with the condition.

Insurers typically assess the type of diabetes (Type 1 or Type 2), the level of control over blood sugar levels, and any related complications before determining premiums and coverage options.

While premiums may be higher compared to those for non-diabetics, many insurers offer tailored policies that accommodate the specific needs of diabetics, ensuring they can still secure essential life insurance coverage.

Compare Life Insurance Quotes for Diabetics

Understanding Eligibility

The first question on many minds is, "Can I get life insurance with diabetes?"

The good news is yes, you can. Life insurance companies do consider diabetes a risk factor, but it's not a deal-breaker.

Eligibility largely depends on your overall health, management of your condition, and the type of diabetes you have.

Types of Diabetes

There are key differences between life insurance for diabetes type 1 and type 2.

Type 1 diabetes, often diagnosed in childhood, generally requires more stringent underwriting compared to type 2, which is commonly diagnosed in adulthood and is often managed with lifestyle changes and medication.

Types of Life Insurance Policies

For those managing diabetes, several types of policies are available including term life insurance, whole life insurance, and guaranteed issue life insurance.

- Term life insurance for diabetics is often more affordable but provides coverage for a set period. Get a FREE Quote.

- Whole life insurance lasts a lifetime and builds cash value but is typically more expensive. Get a FREE Quote.

- Guaranteed issue life insurance is a no-medical-exam policy, best for those who might struggle with traditional underwriting. Get a FREE Quote.

Costs and Premiums

Understandably, people with diabetes might face higher premiums.

According to the American Diabetes Association, premiums can be 25-50% higher for individuals with diabetes.

Factors impacting costs include age at diagnosis, glucose control, presence of complications, and overall health.

Medical Documentation

Preparing adequate documentation is crucial. Insurance providers typically require a detailed medical history, including information on diabetes management, medications, HbA1c levels, and any related complications such as heart or kidney disease.

The more effectively you manage your condition, the more favorable your insurance terms might be.

Finding the Right Provider

Not all insurance companies treat diabetes the same way. Some specialize in high-risk insurance and offer more competitive rates for diabetics.

Research and compare insurers to find those known for favorable terms for diabetes patients.

According to the National Association of Insurance Commissioners (NAIC), companies like Prudential and John Hancock often have more accommodating policies.

Importance of Diabetes Management

Effective management of your diabetes plays a significant role in securing life insurance.

Maintaining healthy HbA1c levels (below 7%), regular check-ups, and a consistent treatment plan can demonstrate to insurers that you're managing your condition well, which can lead to better rates and options.

Comparing Policies

Always compare various policies before making a decision. Use online comparison tools and calculators to evaluate different coverage amounts, rates, and benefits. It’s like shopping for any significant purchase; you want the best value. Compare life insurance quotes.

Long-Term Stability

If your diabetes is well-managed over the long term, you might see reductions in premiums or better terms when renewing or applying for new policies.

According to a LIMRA study, individuals with stable health conditions often have more favorable underwriting outcomes.

Example of Diabetic Life Insurance

Consider John, diagnosed with Type 2 diabetes at 45.

By managing his condition with diet and exercise, keeping regular medical check-ups, and thorough research, he secured a competitive term life insurance policy, ensuring his family’s future is protected.

Premium Reduction Tips

Want to lower your premiums? Showcase your commitment to health. This includes regular monitoring, lifestyle changes, and possibly participating in wellness programs.

Some insurers offer discounts or improved rates for participants in health improvement plans.

Getting Price Quotes

Requesting a free quote is a great way to understand your options without commitment. Many insurers offer online tools where you can input your details and get an estimated premium. This saves time and gives you a ballpark figure to work with.

High-Risk Insurance

For more severe cases or those with additional health issues, high-risk insurance might be necessary. These policies often have higher premiums but are designed to cover individuals with serious health conditions, including unmanaged diabetes. Get a FREE Quote.

Guaranteed Issue Policies

Guaranteed issue life insurance is an option avoiding medical exams or health questions, ideal for those with severe health issues. However, be aware it generally offers lower coverage amounts and higher premiums. Get a FREE Quote.

No-Exam Policies

No medical exam life insurance for diabetes is becoming more popular. It's quicker and easier to obtain, though it might come with certain limitations and higher premiums. This is a good option for those needing quicker approval or those wary of medical exams. Get a FREE Quote.

Financial Planning

Integrating your life insurance into your broader financial plan is essential. Work with a financial advisor familiar with diabetes-related insurance issues to develop a comprehensive plan that covers all bases.

Regulatory and Trend Awareness

Stay updated with industry trends. Reports from the American Council of Life Insurers (ACLI) and the Insurance Information Institute (III) indicate growing awareness and evolving policies catering to diabetes management, which can be advantageous for applicants.

Humanizing the Process

Applying for life insurance with diabetes doesn’t have to be stressful. Engaging with life insurers who prioritize customer understanding and offer personalized advice can make the process smoother and more human.

Resources and Support

Utilize available resources like the National Diabetes Education Program or the American Diabetes Association, which provide guidance on managing diabetes and information on securing life insurance.

Healthy Tip for Diabetics

The American Diabetes Association recommends ten foods that help keep your A1c low:

- Beans

- Dark Green Leafy Vegetables

- Citrus Fruits

- Sweet Potatoes

- Berries

- Tomatoes

- Fish High in Omega-3 Fatty Acids

- Whole Grains

- Nuts

- Low-Fat Milk or Yogurt

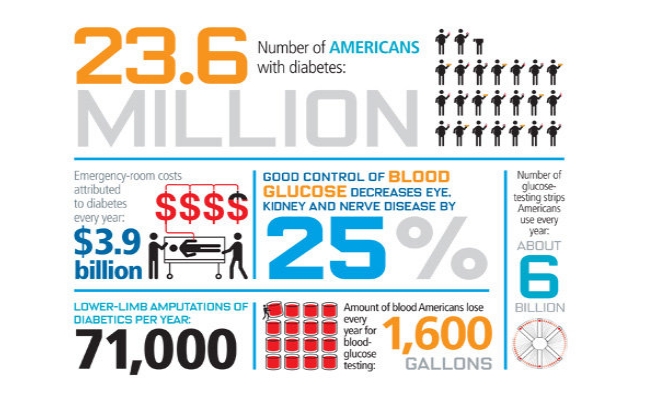

Facts About Diabetes

Nearly 24 million Americans have diabetes, while an estimated 79 million Americans are pre-diabetic, according to the Centers for Disease Control and Prevention.

Tips to Find the Best Life Insurance for Diabetics

- How You Manage Your Diabetes - A main factor in the cost of diabetes life insurance policies for people with type 1 or type 2 diabetes is how well they manage their diabetes. If you have a lower A1C, good blood glucose control, lead a healthy lifestyle, and do not have complications from diabetes, chances are your rate will be more reasonable too.

- Find an Insurance Agent that is Experienced in Obtaining Policies for Individuals with "Impaired Risk" - they will know what carriers may offer you a policy and which one(s) may not. Locate a licensed life insurance agent with access to carriers specializing in life insurance for diabetics.

- Apply for a Policy with a Life Insurance Carrier that Uses "Clinical Underwriting" - which is a process that looks at your total health, not just what health conditions you may have. They may take into consideration how well you manage your diabetes.

- Shop Around and Compare - on the internet, by phone, or through referrals from family and friends. Becoming your own advocate will help you find a life insurance for diabetes policy that best fits your needs and budget.

- Don’t Take No for an Answer - Just because one life insurance carrier rates or declines your application does not mean that another company will not look at you more favorably. Persistence may help you find the right life insurance plan.

Key Factors for Underwriting Diabetic Life Insurance

Currently the most critical underwriting factors for diabetes are:

- Age of onset of diabetes

- Level of control measured by the hbA1c

- Complications resulting from diabetes, such as, neuropathy, retinopathy and heart disease.

It appears the best underwriting and life insurance rates may go to late onset (after age 50), an hbA1c of 6.5 or under, and no complications resulting from diabetes.

Tips on Buying Life Insurance for Diabetics

- Compare Several Price Quotes – Rates may vary by up to 50% or more between insurance companies. Some life insurers may charge you hundreds of dollars less per year for your life insurance. By comparing quotes you could keep more money in your pocket.

- Financial Strength Ratings – Choose an Insurance Company rated "A" Excellent, or better, by A.M. Best Company for financial strength. This means they should be safe, secure, and able to pay their claims.

- Review "Free Look" Period - Many life insurance companies provide a 10-30 day money-back guarantee. If you are not satisfied with your life insurance policy you may return it within this time period for a full refund of your premiums paid. Make sure to check on this before buying your life insurance policy.

- Compare Premium Payment Options – Compare quotes for the different premium payment options of monthly, quarterly, and annually. Paying your premiums monthly may cost you more, than paying your premiums once per year (annual payments).

- Length of Term Options – Choose the term (length of your policy) you need coverage for – 5, 10, 15, or 20 years. Depending on your age, the term available may vary by insurance company.

AIG – American General has been in business for more than 160 years with over 12 million customers. They have specialty underwriting guidelines for people with diabetes.

The majority of diabetics may now receive a non-diabetic rate on their life insurance if they meet certain underwriting requirements.

Final Thoughts

Securing life insurance with diabetes requires understanding your condition, being proactive with management, and thorough research. Take your time to compare policies, ask questions, and use available resources.

Don't let diabetes prevent you from securing your family's future. Request a free quote today and start exploring your options. With the right approach, finding a suitable life insurance policy is entirely achievable.

Life Insurance Quotes for Diabetics

Top Pick – JRC Insurance Group

JRC Insurance Group helps you shop, compare and save on life insurance. Regardless of your age or health background, we'll shop our 40+ insurance companies and find you affordable life insurance you need to protect your family and fit your budget. Compare the best life insurance rates for savings up to 73%. Get Your FREE Quote

Highly Recommended – Globe Life Insurance

Get FREE Information On How $1* Can Buy Up To $100,000 Globe Life Insurance For Adults Or Children

- No Medical Exam – Simple Application.

- No Waiting Period. Buy Direct.

- Rates As Low As $3.49 Per Month.

- The Globe Life Family Of Companies Has Nearly 17 Million Policies In Force.

- No Phone Required. No Credit Required.

- The Globe Life Family Of Companies Has Over $224 Billion Of Coverage In Force.

- Globe Life Is Rated A (Excellent) By A.M. Best Company As Of August 2023.

Highly Recommended – Allstate Benefits Insurance Company

Allstate Benefit's Guaranteed Acceptance policy offers $10,000 to $75,000 of coverage to working applicants between the ages of 18 and 70. Rates start as low as $9.65 per month. There’s no medical exam and no health questions. You cannot be turned down. You can get a quote and apply today. Start Here to get a FREE Quote.

NOTE: To qualify, applicants must be working at least 20 hours per week, and not collecting any form of disability income or SSDI.

Additional Resources:

- Learn How Term Life Insurance Works

- How to Buy Guaranteed Acceptance Life Insurance for Diabetics

- Compare Term Life Insurance vs. Permanent Life Insurance

- Determine How Much Life Insurance You Need

- Review a List of The Top 10 Life Insurance Companies

- American Diabetes Association - Learn about diabetes and review diabetic resources.

Can You Get Life Insurance If You Have Diabetes?

Guaranteed Approval Life Insurance for Diabetics

Life Insurance for Uninsurable People

Disclosure: Compensated Affiliate